A recent survey conducted among Financial Advisors (FAs) based in the US has shown that a large number of ‘mass affluent and high net worth (HNW)’ clients want crypto assets incorporated into their investment portfolio.

The results from the survey which was done by Talos and Coalition Greenwich came up with several interesting figures. Top on the charts is that out of the 537 Financial Advisors (FAs) surveyed, a mammoth 92% of their HNW client category want exposure to digital assets.

However, 30% of these FAs mentioned plans to recommend certain digital asset products to their clients within a three-month timeframe. While 35% mentioned that there has been a significant rise in the interest of their clients over the past year.

The survey was aimed at finding out the overall position of these financial advisors when it comes to digital assets. How much promotion digital assets enjoyed, how client inquiries on virtual assets are responded to, and the overall perception of these FAs on regulations surrounding virtual assets.

David Easthope, author of the survey report noted that the embrace of virtual assets as a real asset class would keep on rising. Easthope who is also a Senior Analyst of Market Structure and Technology at Coalition Greenwich mentioned that FAs believe that there would always be persistence in the demand for virtual assets.

With this obvious growth pattern, the report’s author mentioned that FAs are bracing up to meet this demand by their clients for virtual asset inclusion. And this they are done through the incorporation of virtual investment products.

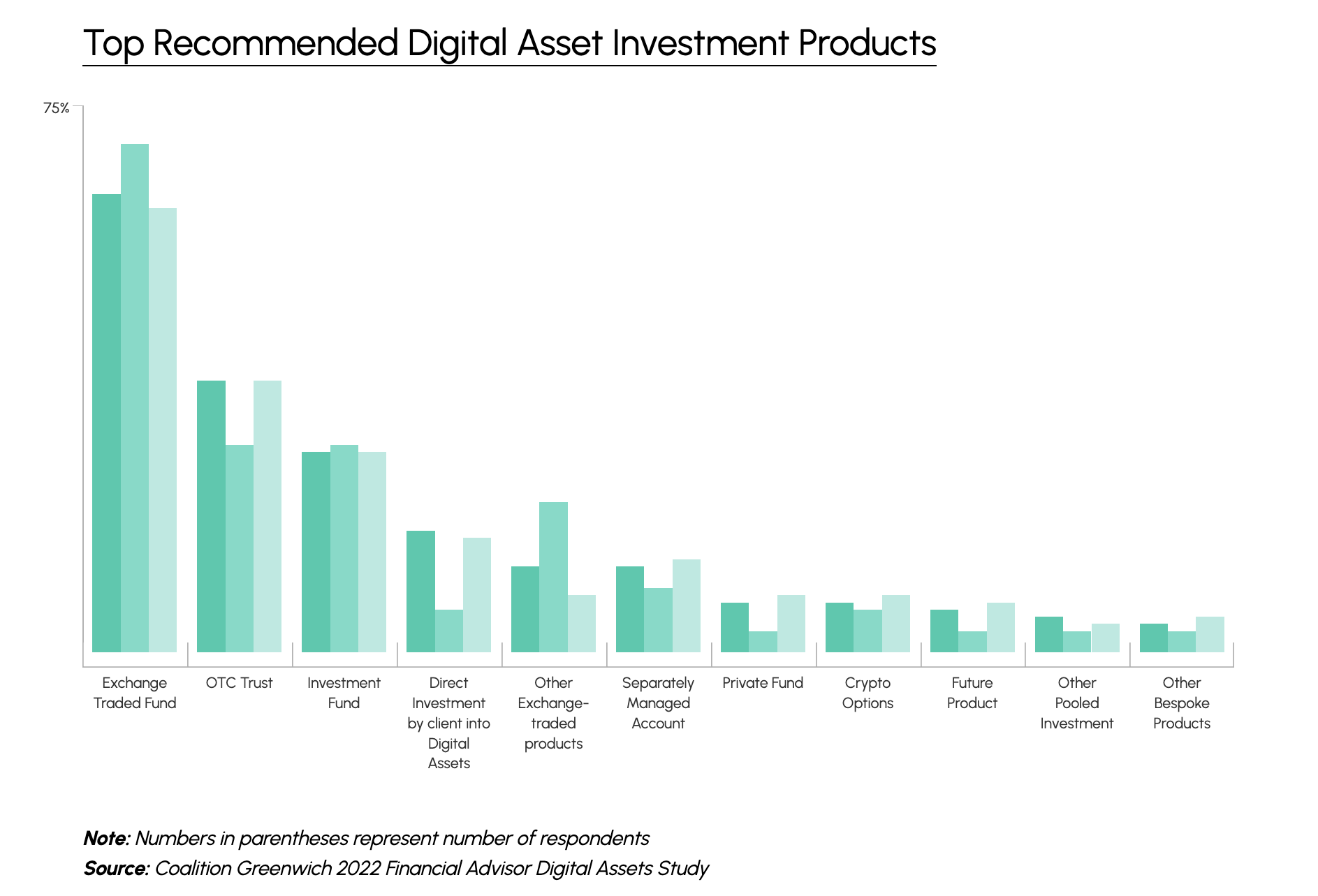

On the question of which digital asset products have the highest recommendation, the survey findings returned a significant result. About 64% of advisors noted that exchange-traded funds (ETFs) enjoy the most recommendation. According to them, this is because ETFs are easy to understand, are well regulated, and are also mainstream.

The FAs were also asked which feature mattered the most when recommending a platform for digital assets to their clients. To this, 69% of FAs picked the compliance approval of the virtual asset over its security and risk.

Crypto remains bullish amid all fears, uncertainty, and doubt

For a market that seems to be undergoing intense turbulence, it is rather amazing to find that the results of this survey were collated in Q3 of the year 2022. A time when the crypto market witnessed the crash of Terra’s USD Stablecoin, the slump of Luna, and also the fold-up of 3AC and many other crypto firms.

Easthope however concluded that the results from the survey conducted by both Talos and coalition Greenwich depict that there would continue to be a long-term demand for digital assets.

Also read: Top five ways to earn passive income on your crypto assets