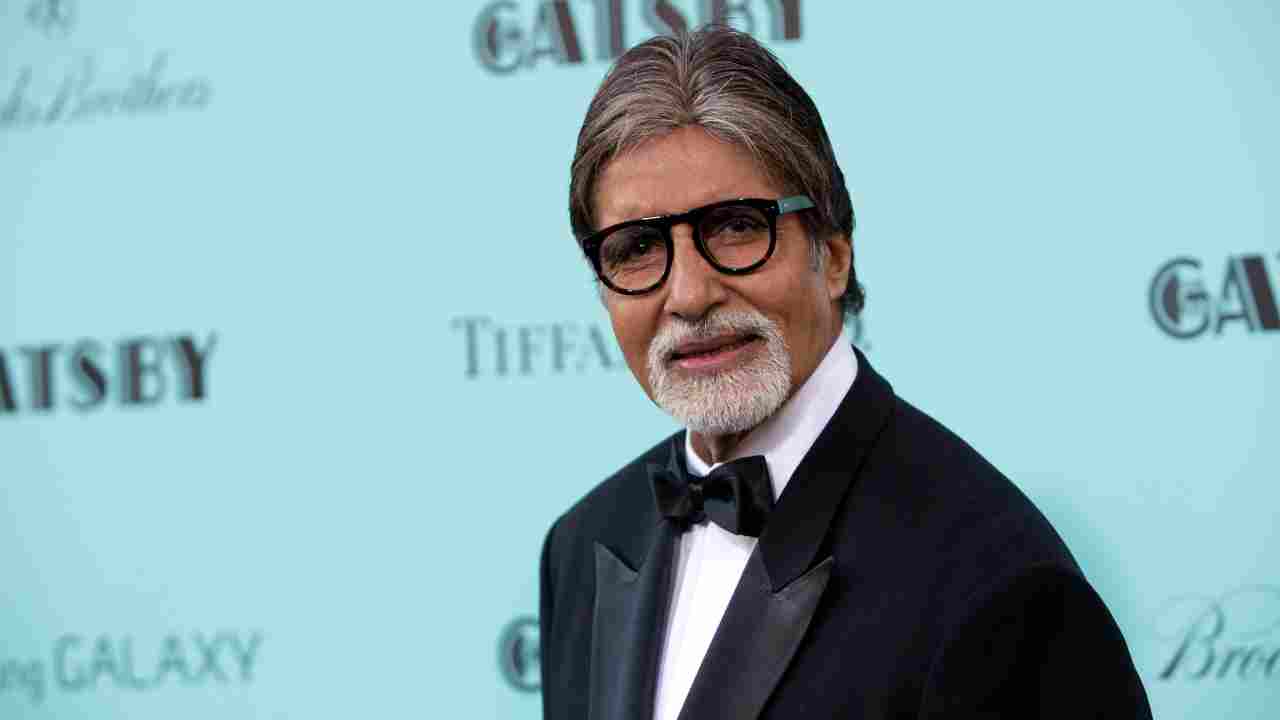

Amitabh Bachchan a Bollywood’s Mega Star under major scrutiny from Indian tax officials, as his collection broke sales records. The veteran actor, 79-year-old was the first to embrace NFTs in Bollywood. This sale reportedly smashed as India’s highest-ever NFT sale, and also regarded him as the first-ever Indian actor to embrace digital assets.

The Veteran actor embraced NFT and regarded his record-breaking sales as a “proud moment” that would eventually pave the path for his fellow stars to embrace digital assets.

Amitabh Bachchan in an interview said,

“In this world of digitization, NFTs have opened a new realm of opportunities to engage with my fans even more than before. The successful auction of my NFTs, some of the most treasured and personal moments of my life and career were so well received and invested in by my supporters.”

After witnessing such gigantic success, several celebrities have onboarded to embrace digital assets — including Bollywood actor Salman Khan and star cricketer Zaheer Khan.

As per the records, the actor paid nearly 1 crore which is $131,000 in taxes as a part of an ongoing investigation into his NFT sales. The star’s NFTs ranged from reciting Madhushala, a famous series of poems that were written by his late father.

A living Bollywood legend of Cinema and Television has been facing this tax scrutiny ever since a huge money auction last year. It is also rendered that digital posters and images were also offered to fans via the auction on BeyondLife.club.

The Veteran Star’s NFT collection generated more than 7 crores which are $917,000 in revenue back in November 2021.

As per the reports, 18% GST has been imposed on the sale of Amitabh Bachchan’s NFT sales.

The actor received a legal notice from the Directorate General of Goods and Services Tax Intelligence notifying him of the bill which he did settle later on but however, the investigation continues to pursue.

India issued a 30% tax on Cryptocurrency and NFT assets

Later this year, India’s Finance Minister Nirmala Sitharaman proposed a 30% tax on digital assets in the Union Budget 2022. India became one of the only few countries to impose a tax on cryptocurrencies and NFTs.

The number of investigations into investors spiked right after the 30% tax which is the country’s highest bracket was introduced. Every cryptocurrency transaction will command a 1% levy; a measure that could drastically reduce the volume of digital asset trade in India.

Nithin Kamath, Zerodha company’s founder predicted that crypto transaction volume in India would “drop off a cliff” substantially when this proposal is implemented. To the least as of now, this would probably eat into an investor’s major chunk of capital.

The Indian government has confirmed that all these taxes proposed will not be offset against other business expenses in the market. The new measures being introduced seem to persuade investors from making a crypto transaction, the 1% levy would impact the market and prohibit from making larger crypto transactions as speculated by traders.

The new tax regime was initially regarded with a welcoming mindset in the country’s legal crypto exchange stature, which was assumed that India would not intend to ban digital assets like Bitcoin, however, Finance Minister, Nirmala Sitharaman, made it very clear that these rules should not be regarded as a legal tender for cryptocurrencies in India.

According to CoinDesk, some of India’s leading crypto exchanges are hereby considering appealing to Supreme Court to challenge the government’s tax bracket on cryptocurrency.

The Supreme Court, two years ago, overturned a controversial ban imposed by the Reserve Bank of India which had stopped financial institutions from facilitating crypto transactions.