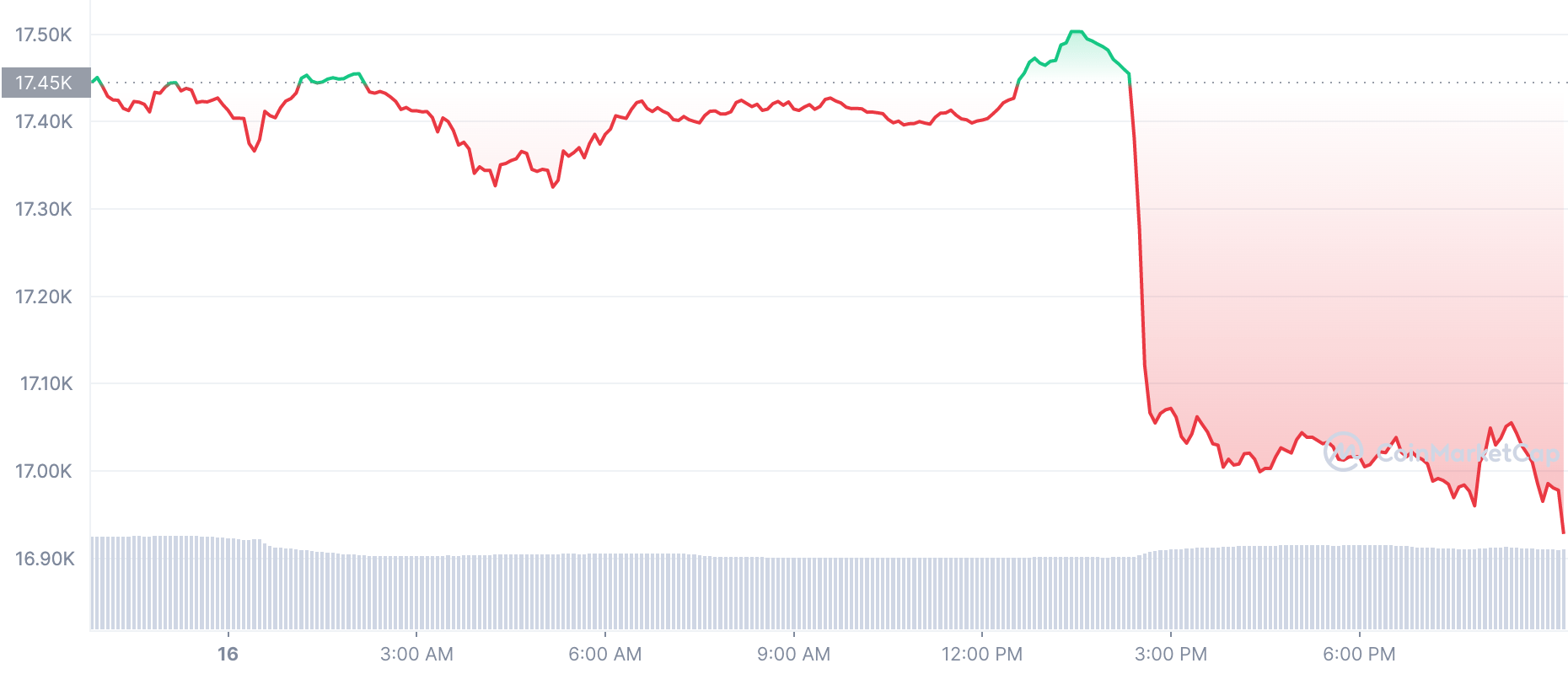

The price of Bitcoin (BTC) today dipped below $17,000 as cryptocurrency traders panic sold a huge stash of their holdings. Among other reasons that could be attributed to this recent price dip of BTC are strong concerns over the insolvency of Binance.

According to data from TradingView, Bitcoin touched a low of $16,928 in the last 24 hours. The BTC/USD pair however took off from this low to fire a retracement to a one-month high. At the time of writing, data from the Binance exchange showed Bitcoin currently trading at $17,014.

Bitcoin price dip- Mere case of FUD and Cold feet

While this drop in the price of Bitcoin has been described as nothing but a mere case of FUD and cold feet, one cannot be too quick to dismiss such fears. Following the shocking collapse of the crypto exchange FTX, the entire market has remained apprehensive about what could happen next.

To dispel growing fear amongst its investors, Binance recently released its Proof of Reserves (PoR). The newly launched website which shows the PoR of the exchange indicates that Binance has a 101 percent reserve ratio.

Going by the BTC reserve of Binance, the exchange seems to have proved that its BTC reserve is sufficient to cover the entire balance of all its users. These figures have however raised red flags.

Binance Proof-of-Reserves under fire

With Binance’s release of its Proof-of-reserves, a report which is meant to reinstate trust in the exchange; a former regulator with the Securities and Exchange Commission (SEC) has defined it as a ‘red flag.” Former regulator, John Reed Stark stated that the Binance PoR

“doesn’t address the effectiveness of internal financial controls.”

Stark who founded the Internet Enforcement Unit of the SEC during his 18-year stay at the commission noted that

“the PoR does not express an opinion or assurance conclusion. “The report falls short in vouching for the numbers”

he stated.

Another red flag from the report which points to Mazars- Binance’s auditing firm is that the report is devoid of information on the quality of internal controls at Binance. And there is also the important question of how the exchange’s system operates asset liquidation in covering margin loans.

Current update on #binance proof of reserve in last 24 hours

-3.5bn outflows of #BUSD

-500m outflows #BTC

2bn inflows of both #USDT and #USDC

Marginal outflow of #ethereum pic.twitter.com/UQqAoSA7tI— James VS (@jimmyvs24) December 14, 2022

BNB price plummets as Binance auditor Mazars tools down

The price of BNB, has responded in the negative as Mazars announced that it would be halting its work with Binance. At the time of writing, BNB- the native coin of Binance exchange is currently trading around $251. This current price indicates a 5.2% decline in price.

This halt which is said to be a temporary one would also affect other crypto exchanges such as Crypto.com and Kucoin. Following this pause, the link to Binance proof-of-reserves has been pulled down from the Mazars website.

Binance CEO Chanpeng Zhao was however quick to react to a question on why an audit firm would choose to cut ties with its crypto exchange clients. Zhao who is popularly called CZ tweeted that

“blockchains are public, permanent records. It’s the most auditable ledger.”

Blockchains are public, permanent records. It’s the most auditable ledger.

— CZ 🔶 Binance (@cz_binance) December 16, 2022

Also Read: How to Research Cryptocurrency