New Delhi: The Reserve Bank of India and the Narendra Modi government have received multiple rules over the last few months to make life easier for “minority community” citizens of Pakistan, Bangladesh, and Afghanistan who reside in India, but exclude the thousands of Muslims who are legal residents of India.

These new regulations which govern from overstaying on a visa to opening bank accounts and buying residential property, appear to go out of their way to exclude Muslims who are citizens in “majority” in these three countries and are legal residents of India. The modified rules explicitly state that they only apply to people from the Hindu, Sikh, Buddhists, Jain, Parsi, and Christian communities.

Senior bankers and corporate lawyers described these regulations as puzzling and certainly open to judicial challenge for violating Article 14 of the India Constitution, which clearly states,

“The State shall not deny to any person equality before the law.”

The Hindu first reported one instance of a change in rules. A Reserve Bank of India source quoted,

“The changes were carried out on the instructions of the Centre,”

on asking if there was anything that can be done to help people who had been residing in the country for a long time.

The changes also light on the new significance of the Citizenship Amendment Act, which grants Indian citizenship to all non-muslim from Pakistan, Bangladesh, and Afghanistan who migrated to India before 2014.

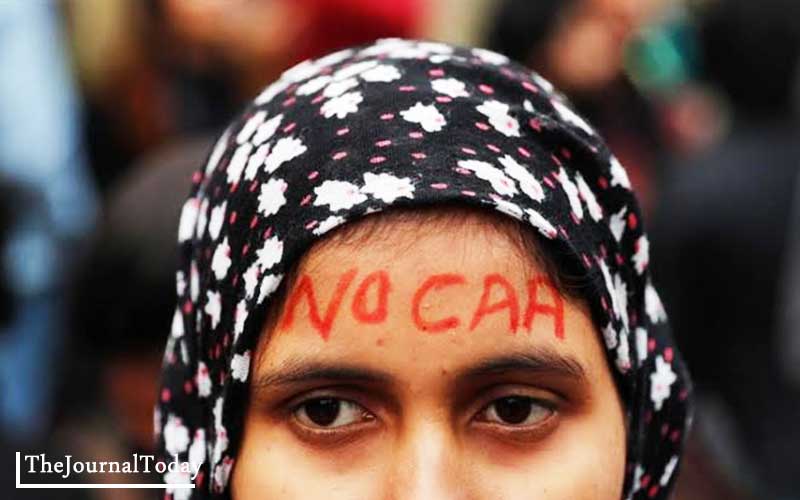

In India, over the last week, protests have broken out across the nation against the Act and calling the new law unconstitutional and discriminatory. Until now, it had been assumed that religious profiling was confined to only grant citizenship to “illegal immigrants” belonging to six specified religions from specified listed countries. However, it now appears that the same discriminatory principle has been extended to the banking system of India as well.

Property buying in India: In March 2018, 20 months before the CAA was passed, the Reserve Bank of India implemented changes to the Foreign Exchange Management (Acquisition and Transfer of Immovable Property in India) regulations.

Section 7 of the new rules introduced a new clause that allowed holders of “long term visas” (LTVs) to buy residential property within India. Although, India has many LTVs from other countries, and many Muslims LTVs from Pakistan, (e.g., Pakistani spouses of Indian citizens who are resident in India), the new clause only applies to LTV holders who are citizens of three listed countries that belong to the minority community in those countries.

A Senior Banker with a state-run lender quoted that,

“The existing rules banned all Pakistani, Afghani, and Bangladeshi citizens from owning residential and immovable property in India without prior permission from the RBI. The existing rules always allowed foreigners to buy property in India after satisfying certain residency requirements, like staying in the country for more than 180 days. But Foreign citizens from several countries have restrictions placed on them for national security reasons. Even Chinese and Iranian citizens can’t buy property in India without specific permission.”

“To help non-Muslim citizens from those three listed countries, these changes appear to have come about in a sort of backdoor mechanism. Whether it is right or wrong, it’s hard to say, but it’s difficult to think of an economic rationale for denying people of certain faiths their rights,”

he added.

Visa Overstay Penalties: In early 2019, India’s external affairs ministry introduced new regulations on the penalty for visitors from Bangladesh, Pakistan, and Afghanistan who overstay their visa and which also discriminates against Muslims. The Bangladeshi officials have criticized the move.

The changed rules states, the members of the “majority” community from these three listed countries now have to pay a penalty that is at least 200 times higher than compared to the ones that would have to be paid by minorities (non-Muslims, and mainly Hindus) if they overstay their visa.

The Foreigner Regional Registration Office (FRRO) rules state that the “penalty of overstay” for “minority communities from Pakistan, Bangladesh, and Afghanistan” is 500 in Indian rupees for more than two years, 200 rupees for 91 days to two years and 100 rupees for up to 90 days.

On the other hand, if the person who overstayed does not belong to the minority community, the charges listed are in dollars – $500 (Rs. 35,000), $400 (Rs. 28,000) and $300 (Rs. 21,000) for all the same duration of overstay visa penalty.

A senior Bangladeshi official said,

“This means if Liton Das (A Bangladeshi cricketer, a Hindu) overstays for a day, then he will have to pay Rs 100, whereas if the person’s name is Sail Hasan, he will have to pay over Rs. 21,000, which is what Mr Hasan paid,”

to the Hindu Times.

The changes will now imply to all India banks and will soon introduce a new column in their KYC (know your customer) forms that would ask for a customer’s religion, says the RBI sources.

A Senior Corporate Lawyer said,

“It is silly either way to expect a bank to be able to verify a person’s religion. How would this done in a manner that can catch all the potential misuse and fraud”.

On Saturday evening, the finance ministry confirmed that the changes would not require Indian citizens to furnish details of religion while opening a bank account, but continued to remain silent on the other discriminatory against Muslims who are here on long-term visas from those three listed countries.